Words definition

Exchange rate - the value of one currency expressed in terms of another currency

Floating exchange rate - The value of a currency determined solely by the demand and supply of the currency on the foreign exchange

Appreciation - ↑ in the free market exchange rate of currency (↑ value of currency)

Depreciation - ↓ in the free market exchange rate of currency (↓ value of currency)

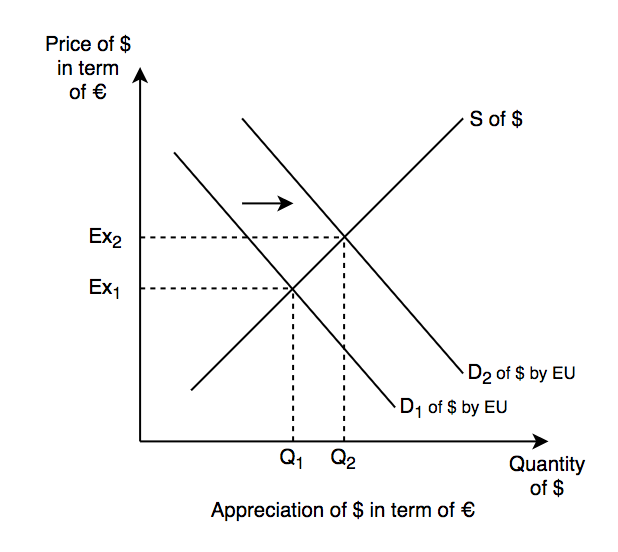

The diagram above shows the appreciation of US $ in term of €

The value of $ will ↑ in EU if more people demand $.

→ demand curve shift to the right → exchange price ↑ from ex1 to ex2

The diagram above shows the depreciation of US $ in term of €

The value of $ will ↓ in EU if fewer people demand $.

→ demand curve shift to the left → exchange price ↓ from ex2 to ex1

The diagram above shows the appreciation of US $ in term of €

The value of $ will ↑ in the EU if the US supply less $ in the market.

quantity supplied ↓ from Q1 to Q2 → supply curve shift to the left → exchange price ↑ from ex1 to ex2

The diagram above shows the depreciation of US $ in term of €

The value of $ will ↓ in the EU if the US supply more $ in the market.

quantity supplied ↑ from Q1 to Q2 → supply curve shift to the right → exchange price ↓ from ex2 to ex1

Why exchange rate change?

1. Change in demand for goods and services

directly affect foreign exchange market

ex) demand for Thailand rice ↑ → need Thailand currency to import rice →

demand for Thailand currency ↑ → appreciation of Thailand currency

2. Change in investment flow

- Buy foreign currency to make the investment to that country

- investment flow ↑ → appreciation

- investment flow ↓ → depreciation

ex) portfolio investment, foreign direct investment

3. Change in relative interest rate

1- interest rate ↓ → saving ↓ → domestic investment less attractive → domestic investment ↓ →

the demand for domestic currency ↓ → depreciation

2- interest rate ↑ → saving ↑ → domestic investment more attractive → domestic investment ↑ →

the demand for domestic currency ↑ → appreciation

4. Change in the relative inflation rate

- affects the overall price level → product less competitive

a) increased supply of currency - price competitiveness ↓, the export price ↑ → depreciate

b) decreased demand for currency - price competitiveness ↓, the export price ↑ → appreciate

5. Change in relative growth rate

- ↑ growth → ↑ income → spend more on domestic goods and services → import ↑ supply ↑ → supply curve shift right (depreciate)

6. Expectation of future growth

- investment ↑ → capital flow ↑ → appreciation

7. Speculation

- buy currency → sell it when it appreciates

Advantage of exchange rate

1. Downward pressure on inflation

- low price of imported goods put pressure to domestic producers to be more competitive

→ the low price of imported goods cool down cost-push inflation

2. ↑ efficiency for a foreign producer

- ↑ exchange rate threatens international competitiveness → downward pressure force ↓cost

3. Purchasing power ↑

Disadvantage of exchange rate

1. Damage to export industries

- price ↑, difficult to export → unemployment

2. Damage to domestic industries

- expensive → Demand for domestic goods ↓ → Aggregate Demand ↓

Advantage of low exchange rate

1. Greater employment in the export industry

2. Greater employment in the domestic industry

Disadvantage of low exchange rate

1. Inflation

- export price ↓ → imports less attractive → ↑ net export → demand-pull inflation

- imports expensive → cost-push inflation →imported raw material makes the cost of production↑

'Group 3 - Individuals and Societies > International economics' 카테고리의 다른 글

| 3.4 Economic Integration (0) | 2020.09.16 |

|---|---|

| [IB International Econ] What is protectionism? (0) | 2020.09.09 |

| [IB International Econ] Why do people trade? (2) | 2020.09.09 |